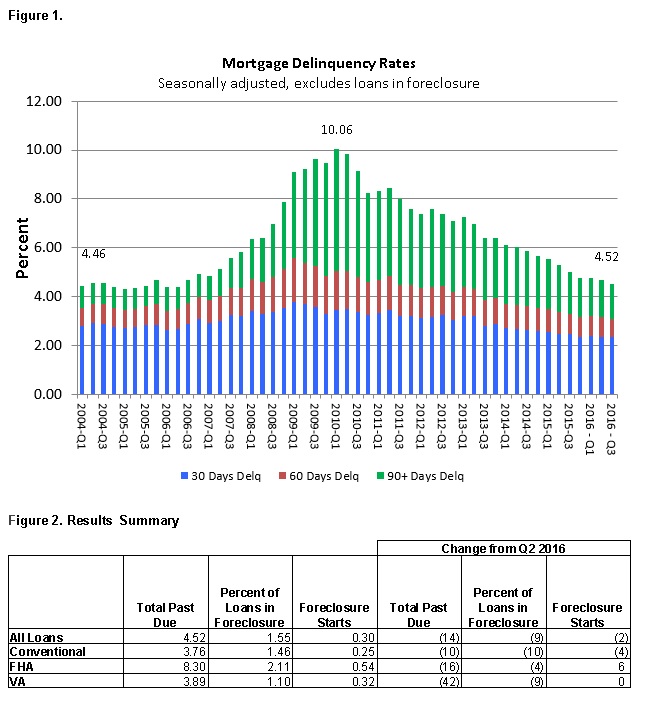

WASHINGTON, D.C. – November 15, 2016 – (RealEstateRama) — The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased 14 basis points to a seasonally adjusted rate of 4.52 percent of all loans outstanding at the end of the third quarter of 2016. This was the lowest level since the second quarter of 2006 when the delinquency rate was 4.39 percent. The delinquency rate was 47 basis points lower than one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The percentage of loans on which foreclosure actions were started during the third quarter was 0.30 percent, a decrease of two basis points from the previous quarter, and down eight basis points from one year ago. This foreclosure starts rate was at its lowest level since the second quarter of 2000.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the third quarter was 1.55 percent, down nine basis points from the previous quarter and 33 basis points lower than one year ago. The foreclosure inventory rate was at its lowest level since the second quarter of 2007.

The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 2.96 percent, a decrease of 15 basis points from previous quarter, and a decrease of 61 basis points from last year. The serious delinquency rate was at its lowest level since the third quarter of 2007.

Marina Walsh, MBA’s Vice President of Industry Analysis, offered the following commentary on the survey:

Mortgage delinquency and foreclosure rates continued to decrease in the third quarter as sustained job growth and low unemployment helped more borrowers stay current with their mortgage payments. Monthly job growth averaged 206,000 jobs in the third quarter, making it the strongest quarter in 2016 thus far. The unemployment rate stayed just below 5 percent and wage growth continued to strengthen. These factors helped the mortgage delinquency rate improve to 4.52 percent in the third quarter. The delinquency rate has decreased in almost every quarter since the beginning of 2013 and is below its historical average of 5.36 percent for the period from 1979 to the present. Additionally, the 30-day delinquency rate decreased three basis points to 2.33 percent and the 60-day delinquency rate decreased four basis points to 0.77 percent from the previous quarter. Combined, the 30-day and 60-day delinquency rate was at its lowest level in the history of the survey dating back to 1979.

Among the various loan types, the delinquency rate improved for conventional loans as well as FHA and VA loans. The FHA delinquency rate dropped to 8.30 percent, its lowest level since the fourth quarter of 1997, while the VA delinquency rate decreased to 3.89 percent, the lowest level in the survey dating back to 1979.

The percentage of new foreclosures initiated in the third quarter was 0.30, making it the lowest rate since 2000 and below the historical average rate of 0.44 percent. FHA loans had a six basis point increase in foreclosure starts, although at 0.54 percent that rate is still below the historical average of 0.60 percent.

Continuing a downward trend that began in 2012, the foreclosure inventory rate declined to 1.55 percent in the third quarter of 2016. The percentage of loans in foreclosure continued to run higher in judicial foreclosure states than in states that utilize a non-judicial foreclosure process and states that use both processes. Regardless, the foreclosure inventory rate continues to decline across the board.

Of the 50 states and Washington, DC, 48 states either had no change or saw declines in the foreclosure inventory rate in the third quarter of 2016. New Jersey and New York had the highest percentage of loans in foreclosure, at 5.79 and 4.32, respectively, but both states saw double digit basis point decreases from the previous quarter.

NDS Note: Starting in the first quarter of 2016, we combined all non-government loans into a single conventional loan category. Conventional loans make up almost 80 percent of the NDS sample. Figure 2 displays key results of this new series.

PLEASE NOTE: If you are a member of the media and would like to view the report please email Ali Ahmad at or call (202)557-2727. If you are a member of the media would like access to a specific state’s statistics, email

or call (202)557-2727.

If you are not a member of the media and would like to purchase the survey, please visit www.mba.org/NDS or e-mail .

© 2016 Mortgage Bankers Association (MBA). All rights reserved, except as explicitly granted.

Data are from a proprietary paid subscription service of MBA and are provided to the media as a courtesy, solely for use as background reference. No part of the data may be reproduced, stored in a retrieval system, transmitted or redistributed in any form or by any means, including electronic, mechanical, photocopying, recording or otherwise. Permission is granted to news media to reproduce limited data in text articles. Data may not be reproduced in tabular or graphical form without MBA’s prior written consent.

The above data were obtained in cooperation with the Mortgage Bankers Association (MBA), which produces the National Delinquency Survey (NDS). The NDS, which has been conducted since 1953, covers 38 million loans on one- to four- unit residential properties. Loans surveyed were reported by over 100 lenders, including mortgage bank, commercial banks, and thrifts.

CONTACT

Ali Ahmad

(202) 557- 2727