Many investors around the globe consider the stock market a better place to put their investing dollars. Investing in stocks, bonds, mutual funds are well-known investments. There is no doubt about that. But, buying real estate is considered a better investment in today’s world. Why?

Real estate investing provides a parallel path to earn money, along with building one’s financial future. First, there are several benefits to investing in real estate. It allows the investors to predict positive cash flows, gain remarkable returns, take advantage of tax breaks and deductions, greater diversification, and, most importantly, real estate appreciation. If asked, investing in real estate or investing in stocks to make money? Invest in numbers.

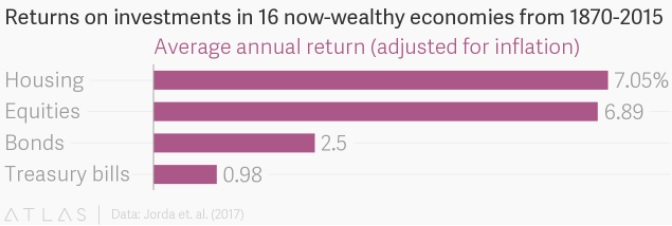

Investing comparisons should be made on the same characteristics; Comparing stocks and real estate is an apple-to-oranges comparison. The factors that affect prices, values, and returns are very distinct. The lead authors of the paper, “The rate of Return of Everything, 1870-2015”, presented by five authors (led by Oscar Jorda and Katharina Knoll), presented a research paper depicting the research work performed on 16 advanced economies over the last century and a half. The study sought to find what asset classes offer the best return on investment. To lead to better results and fair comparison, they made an apples-to-apples comparison. Researchers neutralized all the distinctive features for a fair play.

As depicted in the above graph, the result: residential real estate was found to be the superior investment (averaging over seven percent per year). Equities were second on the list coming in at just under seven percent.

Moreover, Real estate investments come with its perks; Rental income being a vital factor. The majority of the returns on real estate investments can in the form of rental income while the other half came from appreciation.

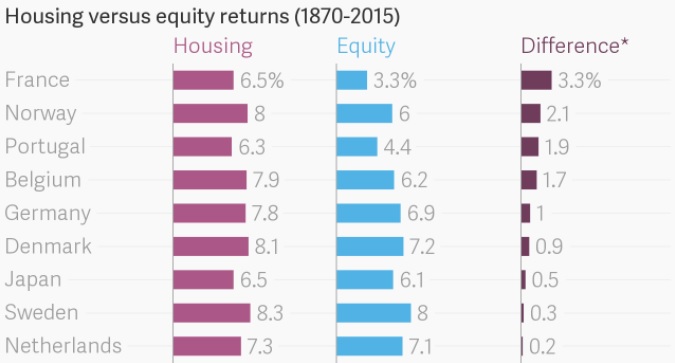

Below is a graph depicting the findings:

Investing in real estate permits you a higher return than investing in stocks. The highest return on housing investment can be seen in France (3.3%), while the lowest in the Netherlands (0.2%).

Not just this, one should logically invest in something that has a more excellent value. Home values, for example, have increased by approximately 7.2% over the past several years (according to the Zillow Home Value Index). In addition, there are nearly 44 million homes in the US currently occupied by renters (this in contrast to the 75 million owner-occupied homes) according to findings published by NHMC.

Three Best Real Estate Investments

Real estate investment might be too much to look after, time-consuming, and require more work. But if done right, real estate investing can be remunerative and worth the while. It can play an important role in diversifying your existing investment portfolio and also an additional income stream.

The drawback is that many new investors haven’t seen the good days yet, as they don’t know about investing in real estate.

Let us have a look at the three best ways to make money in real estate.

- Buy REITs- Real Estate Investment Trusts: these allow one to invest in real estate without actually investing in real estate. Sometimes referred to as mutual funds, companies own commercial real estate consisting of retail spaces, apartments, office buildings, and hotels. REITs allow one to buy and sell publicly-traded REITs on significant stock exchanges. REITs will pay 90% of income to investors.

- Rental property: This is another channel to utilize when investing in real estate. Being careful about the property one chooses and who they rent it to plays a significant part in securing future earnings. Moreover, rental prices rise every year, leading to an increase in your profits.

- House-Hacking: Although it does sound like one is hacking into someone’s house/property, they are not. In-fact, house hacking works by purchasing a multi flat building and living in one unit while renting the other ones. providing the owner income via rent while simultaneously saving money by cutting down on his expenses.

Three Worst Real Estate Investments

- Timeshare: Too many vacationers invest in timeshare, with the expectation of value increases. What slips their mind is the opportunity cost of having the money sit in real estate that doesn’t pay any income. Even more, with maintenance costs and depreciation, the resale value on timeshare is often less than what the purchaser paid. Timeshare is no investment for real estate investors who want steady income and appreciation (even if the salesman promises great returns).

- Reverse cash flow properties: Investing in properties that do not pay cash flows from day one is a wastage of time, money, and effort.

- TIC – Tenant in joint investments: This process was at its peak in the course of two years, from 2005 to 2007, and was used as a way to diversifying the portfolio without actually owning and managing real estate properties. This process was instead very costly and unprofitable, and so faced backlash.

In conclusion, all investments have risks and rewards. Real estate investment, mounting up its value, for saving and long term effect. Investing in real estate is an ideal way to diversify one’s investment portfolio, reduce risks, and maximize returns. Real estate values tend to increase over time, and with a good investment, one can turn a profit when it’s time to sell.