zavvie reveals new iBuyer and Power Buyer Report

Q4 study shows rapid growth for Power Buyers, “breakout” year for iBuyers

BOULDER, Colo. – RealEstateRama – February 17, 2022 – Despite one of the most robust seller markets in real estate on record, with homes selling “faster than you ever thought possible,” iBuyers registered a breakout year in 2021, increasing business fivefold year-over-year according to a new report from zavvie.

The market conditions from October through December, coupled with record-low inventory, presented a challenge for iBuyers, whose value proposition is speed, certainty, and convenience to home sellers.

“iBuyer skeptics would say, ‘Who needs an instant offer from a tech company if you can sell your house on the open market faster than you ever thought possible for more money than you ever expected?’” said Stefan Peterson, zavvie Chief Data Officer and co-founder and author of the zavvie Seller Preferences Report. “Yet iBuyers had a breakout year,” he added.

Collectively, the zavvie report shows iBuyers purchased over 71,000 homes in 2021, approximately 1.3% national market share, compared with about 14,000 in 2020, when the pandemic temporarily paused iBuying — a 5x increase.

The report noted, “It’s time to stop questioning whether iBuying is good or bad and start asking if an instant offer is a good option for your next home sale.”

For Power Buyers, firms offering innovative solutions that dramatically increase a consumer’s home buying power, market conditions were “perfect,” the report notes. Buy Before You Sell, Sale Leaseback, and especially Cash Offer options for home buyers catapulted the growth of Power Buyers and their accessibility to consumers.

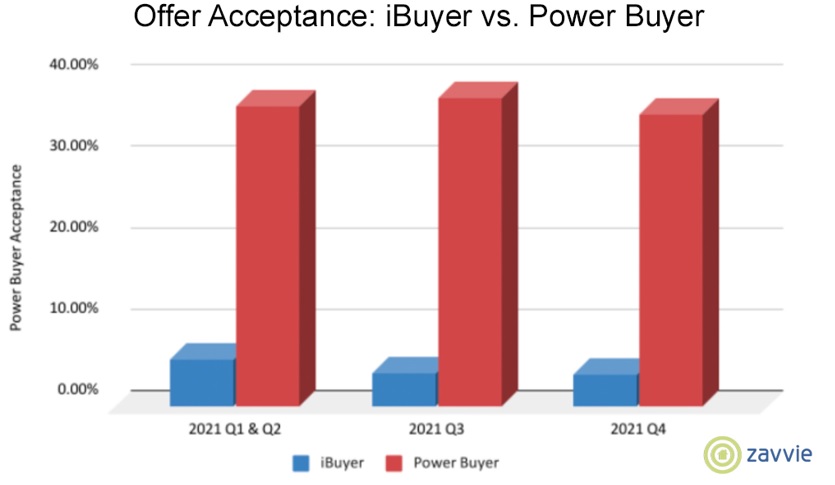

According to zavvie, consumers gained a huge advantage when working with a Power Buyer versus using a traditional mortgage with a loan contingency. Buyers using a mortgage needed to make offers on seven houses before winning an offer. Using a “Cash Offers” program, homebuyers averaged just 1.1 submitted offers before successfully purchasing a home.

The zavvie report notes, “Throughout 2021, the Power Buyers experienced explosive growth and expansion. Ribbon reported demand for its Cash Offers increased 10x in 2021. EasyKnock, which already operates nationwide, more than doubled its business over the year. Knock continued its expansion from three markets at the end of 2019 to 71 markets in 2021. Homeward kicked off a 20-state expansion plan. Flyhomes launched a national expansion as “Flyhomes for Agents,” rolling out in several states.

Highlights from the Q4 zavvie Seller Preferences Report include:

- iBuyers rebound, expand, and establish long-term viability: Despite a major iBuyer exiting the market (Zillow), Opendoor, Offerpad, and RedfinNow all significantly increased their purchasing activity.

- Power Buyers reach a broader range of properties than iBuyers:In Q4 2021, the median price for Power Buyer transactions came in at $485,000 versus $395,000 for iBuyers.

- A giant leap in iBuyer median purchase price:Still, the median purchase price for iBuyers increased from $280,000 in Q4 2020 to $395,000 in Q4 2021, a 41% gain.

- Power Buyers charge lower fees than iBuyers:iBuyer service fees increased slightly to 5.0%, less than what sellers often pay on the open market, while Power Buyer fees range from 0% to 3%.

- iBuyer “buy boxes” stabilize, but a $2.5 million threshold comes to the market:iBuyer “buy boxes” (the targeted purchase price range, age, and other conditions) were consistent with past quarters, but Opendoor launching in the San Francisco Bay area brings home purchases up to $2.5 million. Based on Q4 buy boxes, iBuyers collectively could purchase 47% of properties, up from 32% at the end of 2020.

- Cash offers continue to drive Power Buyer growth:Many Power Buyers continue to report a 2x to 10x increase for cash offers in Q4 compared to Q4 2020.

- iBuyer “prep and repairs” fees drop:Called a seller concession, they decreased in 2021 to an average of 3.1% from 3.6% in 2020.

- Power Buyers and iBuyers both earned higher consumer satisfaction scores:On a 10-point scale, satisfaction among customers of Power Buyers and iBuyers both averaged 9 for 2021.

The zavvie Seller Preferences Report, available for free at zavvie.com/seller-preferences, is the first of its kind covering all the selling solutions available to US homeowners. It reveals the activity and impact of both iBuying and Power Buyers, including market locations, business volume and trends, and current buy boxes. The zavvie report also examines offer strength, offer acceptance rates, service fees, average concessions, time to close, and customer satisfaction.

About zavvie

zavvie is a software technology company that provides real estate brokerages with a marketplace for buying and selling solutions via their own white-labeled platform that keeps agents at the center of the transaction. Over 65,000 real estate agents in 47 states leverage zavvie’s software technology to serve their clients better. Discover more at zavvie.com.

# # #

Media Contacts:

Kevin Hawkins | zavvie

206-866-1220 |